Upfront fast payout

Our policies pay up to $15,000, usually within 24 hours of claim approval. Accidental Death Cover is only covered in the first 12 months of your policy.

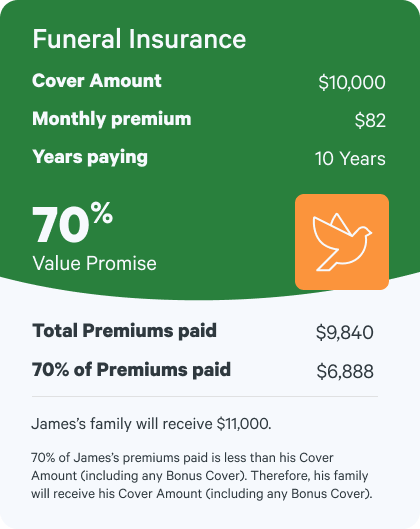

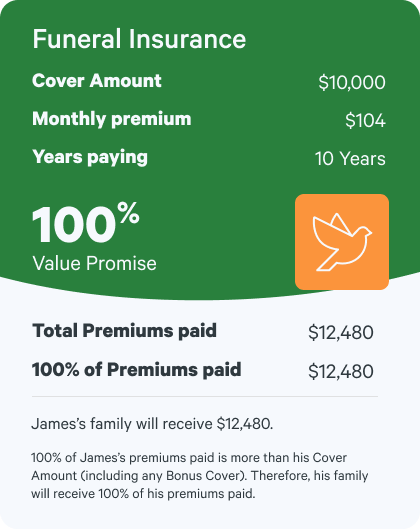

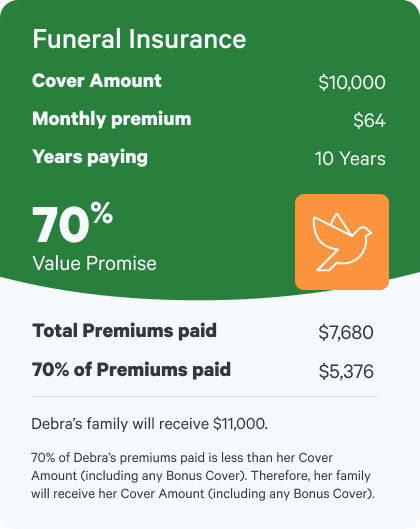

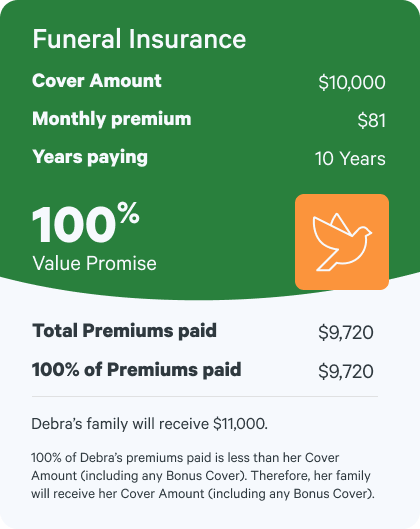

Bonus 10% cover1

An extra 10% of your average funeral cover after 5 years, at no extra cost.

Annual discount

Get 12 months’ cover for the price of 11 when you pay annually.

No medical or health questions

Regardless of how many candles you blew out at your last birthday, we offer guaranteed acceptance if you meet age and residency criteria.

Flexible cover

You can choose how much your policy is covered for, between $3,000 and $15,000.

Flexible payment options

Pay fortnightly, monthly, or annually, with a discount for annual payments.

Early Payout option

From the policy anniversary after you turn 85 you may be eligible to cash out your policy and get 120% of the average cover amount. Applicable to Funeral Cover only and excludes any Bonus Cover or extra Accidental Death Cover.

Cooling off period

If you cancel your policy within 30 days of the commencement date, and you haven’t made a claim, we’ll refund the premium you’ve paid.

Family discounts

Add another adult to your policy and each person will receive a 5% multi-Life discount. The multi-life discount doesn’t apply to the optional Accidental Death Cover.

Worldwide cover

Have the peace of mind of knowing our Funeral Insurance provides worldwide cover 24 hours a day.

Affordable cover

Our policies starts from as little as $2.75 per week.*