Making a Claim

At Insuranceline, you’re at the centre of everything we do. Making a claim can feel overwhelming, but we’re here for you every step of the way.

At Insuranceline, you’re at the centre of everything we do. Making a claim can feel overwhelming, but we’re here for you every step of the way.

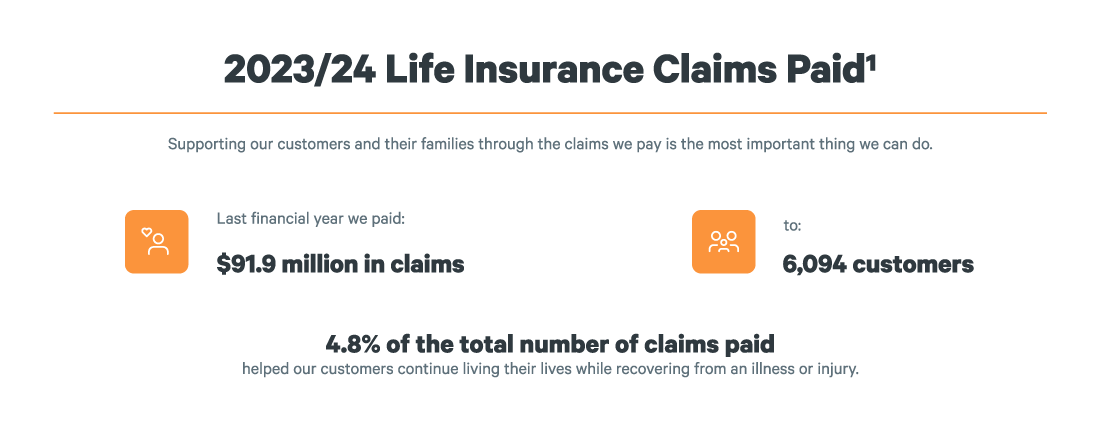

Life insurance isn’t just about payments to families when a loved one passes away. Of the total number of claims paid, 4.8% of these claims were provided to customers living with or recovering from an injury or illness.

If you need to make a claim, we’re committed to guiding and supporting you every step of the way.

Our dedicated claims team will provide you with clear expectations and remove any unnecessary complexities so we can assess your claim as quickly as possible.

Step 1: Contact Us

Step 2: Send your Claim form and supporting documents to:

Step 3: We’ll assess your claim and make a decision in a considered and efficient manner based on the information provided.

The Life Insurance Code of Practice sets out the time frames in which we must assess claims and the steps that we must take as an insurer to notify you if we are unable to assess the claim within those time frames.

Your claims consultant will notify you as soon as possible on the outcome of your claim.

Step 4: If your claim has been accepted, arrangements for payment will be made.

Here you will find the claim forms and supporting documents based on the type of policy you have.

You will need to send us the following documents:

1. The Claim and Medical Authority forms.

2. A certified copy of the Death Certificate, Medical Attendant’s Certificate or another document showing evidence of death.

3. A certified copy of the deceased’s birth certificate, passport or another official document showing their date of birth.

4. A certified copy of proof of your identity and your relationship to the deceased.

Please note:

Documents provided must be in English.

A certified copy is a copy signed and certified as being a true and accurate copy of the original document by a person who is authorised by law to certify documents. Legal practitioners, Justices of the Peace, police officers and chemists are some of the individuals who are authorised by law to certify documents.

Do you need help?

If you need assistance with your claim, please contact us.

If you’re experiencing financial difficulties, Centrelink may be able to help you with a bereavement payment, bereavement allowance or a widow’s allowance. For more information, call Centrelink on 13 28 50.

You will need to send us the following documents:

1. The Claim form and Initial Medical Report.

2. A certified copy of proof of your identity such as your driver’s license or passport.

3. Any additional medical information you have available.

4. Call us to ascertain the type of financial information we require.

Your claims consultant will also contact you after the initial assessment to request any additional information.

Documents provided must be in English.

A certified copy is a copy signed and certified as being a true and accurate copy of the original document by a person who is authorised by law to certify documents. Legal practitioners, Justices of the Peace, police officers and chemists are some of the individuals who are authorised by law to certify documents.

You may be required to provide us with a Progress Medical Report. Your claims consultant will advise you if this is required.

You are responsible for the costs of providing the initial and ongoing information or documents to support your claim. However, we will pay any costs for anything above our standard requirements.

Do you need help?If you need assistance with your claim, please contact us.

You will need to send us the following documents:

1. The Claim form.

2. A copy of the Death Certificate, Medical Attendant’s Certificate or another document showing evidence of death.

3. A copy of the deceased’s birth certificate, passport or another official document showing their date of birth.

4. A copy of proof of your identity and your relationship to the deceased.

These documents must be certified if the death occurs overseas, or the combined value of insurance exceeds $20,000.

Please note:

Documents provided must be in English.

A certified copy is a copy signed and certified as being a true and accurate copy of the original document by a person who is authorised by law to certify documents. Legal practitioners, Justices of the Peace, police officers and chemists are some of the individuals who are authorised by law to certify documents.

Do you need help?

If you need assistance with your claim, please contact us. We know that adjusting after someone dies is never easy, but help is never far away.

If you’re experiencing financial difficulties, Centrelink may be able to help you with a bereavement payment, bereavement allowance or a widow’s allowance. For more information, call Centrelink on 13 28 50.

You will need to send us the following documents:

1. The Claim and Medical Authority forms.

2. Any information to confirm the cause of death meets the accidental death policy definition eg. Hospital Discharge Summary, Ambulance Reports, Coroner's Report, etc.

3. A copy of the Death Certificate, Medical Attendant’s Certificate or another document showing evidence of death.

4. A copy of the deceased’s birth certificate, passport or another official document showing their date of birth.

5. A copy of proof of your identity.

These documents must be certified if the death occurs overseas, or the combined value of insurance exceeds $20,000.

Please note:

Documents provided must be in English.

A certified copy is a copy signed and certified as being a true and accurate copy of the original document by a person who is authorised by law to certify documents. Legal practitioners, Justices of the Peace, police officers and chemists are some of the individuals who are authorised by law to certify documents.

Do you need help?

If you need assistance with your claim, please contact us. We know that adjusting after someone dies is never easy, but help is never far away.

If you’re experiencing financial difficulties, Centrelink may be able to help you with a bereavement payment, bereavement allowance or a widow’s allowance. For more information, call Centrelink on 13 28 50.

You will need to send us the following documents:

1. The Claim form.

You will need to send us the following documents:

1. The Claim form and Initial Medical Report.

2. A certified copy of proof of your identity such as your driver’s license or passport.

3. Any additional medical information you have available.

4. A certified copy of proof of your identity such as your driver’s license or passport.

5. Call us to ascertain the type of Occupational information we require.

Your claims consultant will also call you after the initial assessment to request any additional information.

Please note:

You are responsible for the costs of providing the initial and ongoing information or documents to support your claim. However, we will pay any costs for anything above our standard requirements.

Documents provided must be in English.

A certified copy is a copy signed and certified as being a true and accurate copy of the original document by a person who is authorised by law to certify documents. Legal practitioners, Justices of the Peace, police officers and chemists are some of the individuals who are authorised by law to certify documents.

Do you need help?

If you need assistance with your claim, please contact us.

You will need to send us the following documents:

1. The Claim form.

2. A certified copy of the Death Certificate, Medical Attendant’s Certificate or another document showing evidence of death.

3. A certified copy of the deceased’s birth certificate, passport or another official document showing their date of birth.

4. A certified copy of proof of your identity and your relationship to the deceased.

Please note:

Documents provided must be in English.

A certified copy is a copy signed and certified as being a true and accurate copy of the original document by a person who is authorised by law to certify documents. Legal practitioners, Justices of the Peace, police officers and chemists are some of the individuals who are authorised by law to certify documents.

Do you need help?

If you need assistance with your claim, please contact us. We know that adjusting after someone dies is never easy, but help is never far away.

If you’re experiencing financial difficulties, Centrelink may be able to help you with a bereavement payment, bereavement allowance or a widow’s allowance. For more information, call Centrelink on 13 28 50.

You will need to send us the following documents:

1. The Claim form.

2. A certified copy of the evidence of the illness.

3. A copy of recent radiology or histology reports, if applicable.

4. A certified copy of proof of your identity such as your driver’s license or passport.

Please note:

Documents provided must be in English.

A certified copy is a copy signed and certified as being a true and accurate copy of the original document by a person who is authorised by law to certify documents. Legal practitioners, Justices of the Peace, police officers and chemists are some of the individuals who are authorised by law to certify documents.

Do you need help?

If you need assistance with your claim, please contact us. We know that adjusting to a major illness is never easy, but there is help available. If you’d like to talk to someone about what you’re going through, you can call one of the following organisations:

If you’re experiencing financial difficulties, Centrelink may be able to help you with a bereavement payment, bereavement allowance or a widow’s allowance. For more information, call Centrelink on 13 28 50.

Delivering on our promise to support our customers through the claims we pay is the most important thing we can do. We are committed to delivering on the promise we make to every customer, ensuring they understand and feel confident in how we will handle their claim.

We understand that life insurance claims are made during an incredibly emotional and difficult time. You’ve trusted us to take care of you and your loved ones during this time, and we want to do just that.

1 Claims paid figures relate to all Insuranceline life Insurance, Income Protection and Funeral insurance between 1 April 2023 and 31 March 2024. All claims are assessed against the applicable Product Disclosure Statement and are administered and settled by the insurer, TAL Life Limited.

* Claims statistics based on total claims paid under TAL Life Limited and TAL Life Insurance Services Limited insurance products (including funeral insurance) between 1 April 2023 and 31 March 2024.

Insuranceline Products

Get Online Quote

Important Information

Existing Customers

Contact Us

2026 © Insuranceline

^ The '$100 off first year discount' is available to new customers who take out a quote and purchase a new Insuranceline Life Insurance, Income Protection or Funeral Insurance policy between 28 August 2025 and 26 August 2026. The $100 is spread evenly across the first year's premium payments; full benefit requires maintaining the policy for 12 months unless premiums are paid annually. If the policy is cancelled or payment frequency changes during the first year, any unallocated portion of the discount will not be honoured. This discount applies only once per policy and does not continue after the first year. TAL as issuer of the policy reserves the right to change or withdraw this offer for future customers at any time without prior notice.

Any financial product advice is general in nature only and does not take into account any person’s objectives, financial situation or needs. Before acting on it, the appropriateness of the advice for any person should be considered, having regard to those factors. Persons deciding whether to acquire or continue to hold life insurance issued by Insuranceline should consider the relevant Product Disclosure Statement (PDS). The Target Market Determination (TMD) for the product (where applicable) is also available.

Promoted by Insuranceline, a trading name of TAL Direct Pty Limited (of Level 16, 363 George Street, Sydney NSW 2000) ABN 39 084 666 017 AFSL 243260. TAL Life Limited ABN 70 050 109 450 AFSL 237848 issues the life insurance benefits. Hallmark General Insurance Company Ltd ABN 82 008 477 647 AFSL 243478 issues the Involuntary Unemployment Cover.

The ways in which Insuranceline collects, uses, discloses and secures your personal information are set out in the Insuranceline Privacy Policy, which is available free of charge on request.