Upfront fast payout

Up to $15,000, usually within 24 hours of claim approval. Accidental Death Cover only in the first 12 months of your policy.

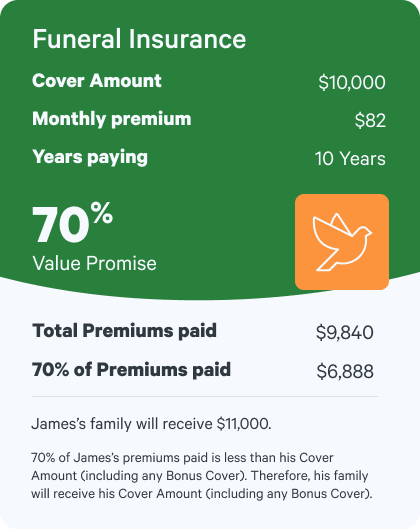

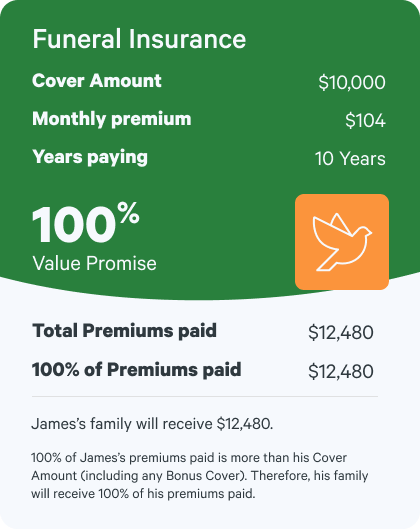

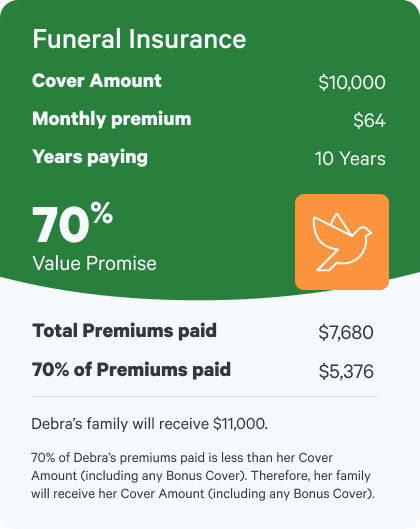

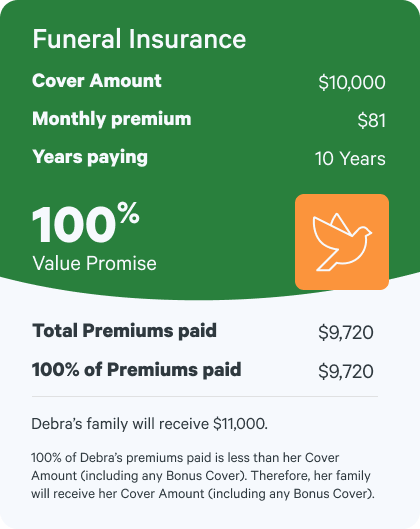

Bonus 10% cover1

An extra 10% of your average funeral cover after 5 years, at no extra cost.

Annual discount

12 months’ cover for the price of 11 when you pay annually.

No medical or health questions

Guaranteed acceptance if you meet age and residency criteria.

Flexible cover

Your choice in how much you’re paid out, from $3,000 up to $15,000.

Flexible payment options

Pay fortnightly, monthly, or annually.

Early Payout option

On your policy anniversary after turning 85, cash out your policy and get 120% of the average cover amount. Applicable to Funeral Cover only and excludes any Bonus Cover or extra Accidental Death Cover.

Cooling off period

If you cancel your policy within 30 days of the commencement date, and you haven’t made a claim, we’ll refund the premium you’ve paid.

Family discounts

Add another adult to your policy and each person will receive a 5% multi-Life discount. The multi-life discount doesn’t apply to the optional Accidental Death Cover.

Affordable cover

Starts from as little as $2.75 per week.*