- Existing Customers

- About Us

Life Insurance

With a lump sum payment of up to $1.5M, your family can cover daily living expenses like bills, school fees, and rent or mortgage while they get back on their feet again.

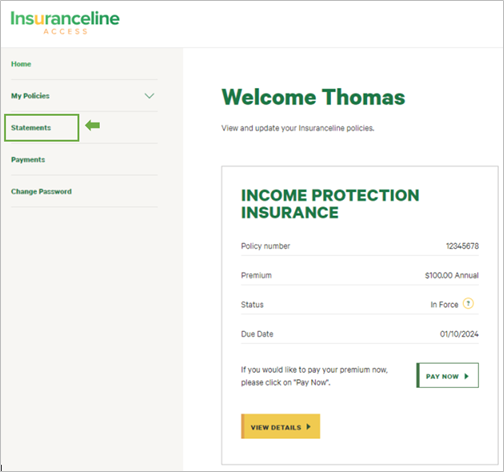

Income Protection

If you're unable to work because of serious illness or injury, we can provide you with a steady stream of income to help cover your bills.

Funeral Insurance

Help your family take care of funeral and other unexpected costs with cover of up to $15,000.